The Untold Truth Of Jim Cramer

Jim Cramer is the face of CNBC, and Mad Money — his daily look at what the financial markets did that day and where they might head in the future — is the cable news channel's signature show. That's because Cramer, in addition to being a savvy investor and veteran of different sectors of the complex financial world, is so good at explaining the ups and downs of the stock markets to viewers. He's also really entertaining, talking fast, pacing around his set, and expressing seemingly every emotion through the medium of yelling. Mad Money could legitimately be retitled Stock Screaming and people would still watch it.

Along with his work on his website TheStreet, his books, and appearances on other CNBC shows besides Mad Money (particularly the morning news show Squawk on the Street), Cramer has become a trusted guide for people who wanted to invest their hard earned money. He's become a public figure along the way, too, but there's a lot more to his story than fans may already know. Here's the untold truth of Jim Cramer.

He made a Harvard professor see crimson

Financial news is a kind of journalism, and before he delved into that, Cramer was just a regular, old-fashioned newspaper journalist. He was apparently pretty good at it, too — as an undergraduate at Harvard in the '70s, he served as president of the institution's newspaper of record, the Harvard Crimson. Despite the long hours associated with such a job, Cramer graduated from the Yale of Massachusetts in 1977 with honors (magna cum laude), and yet he didn't get to walk across the stage and accept his diploma publicly.

At the tail end of his matriculation, Cramer wrote and published a criticism of a professor and administrator named Alan Heimert, who had publicly come out against expanding the History and Literature Department, arguing that such a move would damage the school's small student-to-faculty ratio. Another professor secretly came to Cramer and told him that Heimert spread that dubious info among faculty. As Heimert was head of the department in which Cramer would graduate, he could prevent Cramer from walking, and so he did. "My parents were in tears," Cramer later told the Crimson, adding that he eventually received apologies from the school, as well as Heimert.

Write on, Jim Cramer!

Despite the decidedly negative lesson he learned about journalism at the Harvard Crimson, Cramer pressed on with writing. During a commencement speech he delivered at Bucknell University in 2018 (via CNBC), Cramer said that after graduation, he moved back in with his parents and immediately started searching for reporter jobs, especially important since his father said he'd have to start paying rent in a few months. Still, his parents encouraged him to find a "real job," or pretty much anything other than journalism. "Pops didn't even believe that being a writer was a profession," Cramer said. "He wanted me to get an honest job."

Cramer says he received nearly 50 rejection letters before the Tallahassee Democrat in Florida hired him on. In that capacity, he was among the first reporters to cover the 1978 murders by serial killer Ted Bundy at Florida State University. Having built up his experience and skills, Cramer then jumped over to the Los Angeles Herald Examiner, a newspaper which had previously turned him down for a job.

California broke him

While living in the famed City of Angels, Cramer's apartment was burglarized, and he says the thieves took basically everything, somehow even hacking into his finances. "Everything was gone. They even looted my bank account, so I had no money," Cramer told the Sacramento Bee.

No money meant he couldn't make rent, and so he was evicted, and had to live in his car for a while. That's when he says an editor at the Los Angeles Herald Examiner "felt bad" for him and assigned him to the state government beat in Sacramento, which afforded him a nice expense account. Cramer covered the administration of Governor Jerry Brown (the first time he was governor of California), whom he says "was very combative." Unfortunately, the bad luck returned, and Cramer didn't get to accompany Brown (and the governor's girlfriend at the time, singer Linda Ronstadt) on a trip to Africa because he came down with mononucleosis and a case of jaundiced liver.

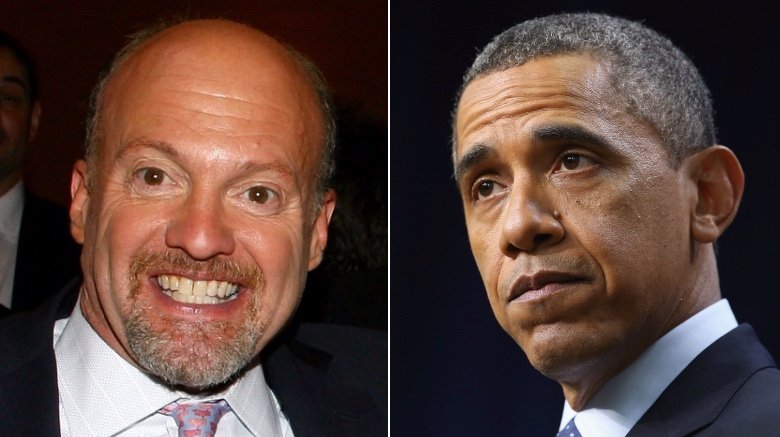

His feelings toward Barack Obama? They're complicated

The experience of suffering severe health problems in California 40 years ago stayed with Cramer. He told the Sacramento Bee that he didn't have health insurance while living in The Golden State, so he sought out low-cost care at a clinic 40 miles outside of Sacramento in Yuba City, California, one of the many that catered to farmworkers in the agriculture-heavy area. Knowing what it feels like to be poor and sick made Cramer "sympathetic to the president's stance on health care," Cramer told the Sacramento Bee in 2014, referring to then-president Barack Obama and the Affordable Care Act (also known as "Obamacare"). "It's still frightening to remember what it's like to not have health care."

But that doesn't mean Cramer 100 percent backed everything President Obama did and said. In 2009, Cramer called the president the "greatest destroyer of wealth." Why? "The president came in with very little understanding of how the stock market worked," stock market expert Cramer said. "I felt he had it wrong with a failed stimulus plan to try and get the country back economically. I felt job creation was the No. 1 priority."

Ultimately, Cramer seems to pride himself on his bipartisan digs at both sides of the political aisle, telling the publication, "There are people who call me a tea partyer and there are people who call me a Trotskyite. So I must be doing something right."

He hedged his bets

By 1981 Cramer said goodbye to journalism and went back to school — his old school, Harvard — to procure a law degree. But around the same time he first delved into legal affairs, he still harbored ambitions of trading stocks and other securities for a living, so he applied for a job at investment firm Goldman Sachs.

"I loved the stock market and while I wanted to be a prosecutor, I knew that the summer between your first and your second year at law school tended not to impact where you ultimately worked," Cramer told writer Anne Kreamer. Unfortunately for him, the famous firm "didn't want law school kids. They wanted business school students." So, Cramer embarked on a "two year odyssey to prove that I deserved a slot." After ten interviews, he finally got hired in the Securities Sales department, but by 1987 he'd tired of the Goldman grind. "So I made the most stupid and brilliant move of my life, I quit." He went into business for himself, opening his own hedge fund.

His years on TheStreet

Cramer co-founded TheStreet in 1996, placing it among the first major consumer-level financial news and commentary sites. TheStreet went public in 1999, allowing consumers to buy stock in a company that tells them what other stocks to buy. It might not be such a good deal, however. In 1999, TheStreet's valuation was around $1.7 billion ... which fell to just over $100 million by early 2019.

Even though he's still responsible for a TV show or two most days, Cramer remains a regular contributor to TheStreet, writing commentary and market wrap-ups for the site's premium subscribers, sending out a twice-a-day newsletter ("The Daily Booyah!"), and appearing in video segments.

Cramer also remains a part of the company's board of directors. It's good that he can still maintain some control over a firm he began more than 20 years ago. It's not so good because he could potentially share the blame and may absorb suspicion whenever the Securities and Exchange Commission starts sniffing around. In 2012, the SEC charged TheStreet Inc. with fraud, alleging that the company "filed false financial reports throughout 2008 by reporting revenue from fraudulent transactions at a subsidiary." Additionally, the named executives (which did not include Cramer specifically) allegedly falsified contracts and other documents to help make that fake accounting appear legitimate.

To market, to market, to manipulate that market

Stock traders use all the information and knowledge of market trends they've got when deciding whether to buy or sell securities. Jim Cramer's toolbox is much larger, because he's got connections and influence. According to Gawker, Cramer faced allegations that he's used his media platforms to bend the market to his will, increasing the odds that he'll make money. In other words, he doesn't have to guess how a stock is going to perform because he can just make that stock do what he wants it to do.

While writing for SmartMoney in 1995, he characterized "four stocks as good buys," and full disclosure, he'd already invested in one of them. Actually, not-so-full disclosure, because his company, Cramer & Co., held stakes in all four companies, as much as 10 percent in two cases. That led to an "informal" SEC investigation, and SmartMoney's parent company created new rules that barred "columnists from writing about securities they owned."

Gawker also pointed out a 1998 episode of Squawk Box, when Cramer proclaimed that stock in the company WavePhone "was overvalued," and that he'd just personally "shorted 25,000 shares" of it. "Short" means to predict a stock will lose money, and after Cramer trashed WavePhone on TV (and then interviewed its CEO), its stock price fell 38 percent, meaning Cramer made a tidy sum that day. That led to a brief suspension of Cramer from CNBC and another SEC investigation (from which Cramer was cleared).

Cramer said don't be bearish with Bear Stearns and he barely got out unscathed

From 2007 to 2009, the so-called "housing bubble" collapsed and countless homeowners were left "underwater," meaning they owed far more money on their houses than they were worth. That led to delinquencies and foreclosures and a subsequent lack of funds for the financial institutions who'd allowed it all to happen, including investment bank and brokerage Bear Stearns. In 2007, a share in the company traded at a robust $150, but by March 2008, its value had dropped to just $62.

That relatively quick collapse prompted a Mad Money viewer to write in to the show's question-and-answer segment. On the March 11, 2008 episode, Jim Cramer read a letter from "Peter," which asked, "Should I be worried about Bear Stearns in terms of liquidity and get my money out of there?" Cramer's emphatic reply: "No! No! No! Bear Stearns is not in trouble. If anything, they're more likely to be taken over. Don't move your money from Bear." Just five days later, Bear Stearns collapsed. After trading closed at around $30 a share, JP Morgan Chase bought out / bailed out the firm at a cost of $2 per share.

Jim Cramer's credibility suffered a major blow. In the months following, numerous talking heads criticized him; Jon Stewart eviscerated Cramer to his face on an episode of The Daily Show, and New York University professor and economist Nouriel Roubini called the Mad Money host "a buffoon."

He outfoxed Fox...

Mad Money is the most famous Jim Cramer financial news show, airing on CNBC since 2005, so it's odd to think that Cramer could have just as easily become a personality on rival network, Fox News. For the more conservative outlet, Cramer created The Street, a TV adaptation of his website, which aired very briefly in 2000. According to The Washington Post, Cramer got in hot water when he discussed Fox stock on the air, promising that while its value "had fallen more than 90 percent, [it] would rebound." That raised questions of ethics and conflict of interest for Fox News, which released a statement saying that the network does "not approve of the touting of stock for personal gain on the air."

That made Cramer so mad he pulled out of his agreement to make The Street ... which prompted Fox News to sue him for breach of contract. And then Cramer countersued, alleging that higher-ups at Fox had done what he'd gotten in trouble for doing. His countersuit pointed to a February 2000 appearance by Rupert Murdoch on Fox News's Your World with Neil Cavuto. Murdoch, CEO of Fox parent company News Corp, reportedly urged viewers to buy into his company, because it was "very, very cheap" and that financial wizards were "just beginning to realize the underlying value in the company." The case was eventually settled, but there's enough bad blood there to make Jim Cramer a CNBC company man for a good long while.

...and then he got Stoned

Jim Cramer's legal matters are usually business-based, but they can also be for personal, non-Wall Street or TV matters, too. For example, there's that time in 2009 when he sued a neighbor who he alleged bilked him out of a few million bucks.

According to NJ.com, between 2000 and 2003, Jim Cramer and his then-wife, Karen Cramer, invested more than $4 million in the Stone Foundation, "a real estate redevelopment firm" owned by D. Wyatt Stone, their neighbor when they lived in Summit, New Jersey. But according to Cramer's lawsuit against Stone, that money didn't get invested in property flipping — the Cramers assert that "Stone used the money for his own expenses and to buy three properties in Mexico." First, the Cramers settled individually with Stone and got $1.3 million of their money back, but still had a suit going against Stone's accountant, which lawyers settled in 2015 just hours before Cramer was set to (very loudly, probably) testify.

The couple who owns a Mexican restaurant together stays together

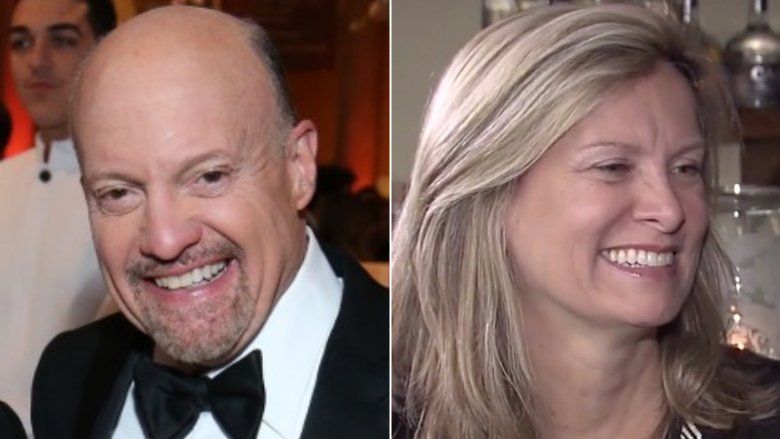

Jim and Karen Cramer ultimately divorced, but he found love again. In 2015 he married for a second time, to Brooklyn Heights real estate broker Lisa Detwiler, who was also marrying once more. They first met nine years before, "set up by a mutual acquaintance," a meeting Detwiler dreaded. "I remember saying that there was no way I was going to go out with that bald, screaming man," she said in the couple's New York Times wedding announcement. "But then the person who set us up reminded me that I had been spending too much time at home watching television with my dog." So there you go, Jim Cramer is better than TV and dogs (although there's nothing better than TV dogs).

Cramer and Detwiler bonded over shared experiences, like having kids and going through divorces. The couple also shares a love of Mexico, where they own a vacation home, which, according to the Pardon Me For Asking blog, led to them opening Bar San Miguel, a "traditional Mexican" restaurant and watering hole in the Carroll Gardens neighborhood of Brooklyn. Of the venture, the Cramers' partner Regina Myers said it's was a way for them to "bring a bit of Mexico home with them, so that they can feel as though they are on vacation all the time."

Jim Cramer knows Iron Man

When you've got a signature look (dress shirt, bald head, beard), presentation style (yelling), and are on TV everyday telling strangers what to do with their money, you're probably going to seep into the mainstream popular culture. In 2016, George Clooney starred in the Jodie Foster-directed Money Monster as Lee Gates, a financial TV personality who hosts a loud and flashy cable show where he tells people what securities to buy and sell ... until a bankrupted viewer breaks into the show and holds him hostage on the air. Gates, and the show-within-a-movie Money Monster sounds an awful lot like Jim Cramer and Mad Money. However, Foster denied any intentional similarities. "There are a lot of financial hosts, he's just the most famous," she told Fortune. George Clooney similarly dismissed those notions to Entertainment Weekly. "So what I liked about this role was that it represents more than just a Jim Cramer kind of guy. Somebody said that Jim Cramer is afraid I'm playing him. I'm not." Whatever you say, Batman.

Regardless of that, Cramer has actively assisted Hollywood. He played "himself" in Iron Man 2, advising on a fictional Mad Money episode to "abandon ship" on Stark Industries. And, in his book Confessions of a Street Addict, Cramer claims that he worked as a consultant on the stock market drama Wall Street.