Country Stars Who Can't Afford Their Lavish Lifestyles

It happens all the time in entertainment: First, a person dreams of stardom. Then it comes true, and they experience fame while their bank account widens. From there, the actor, singer, athlete, or rapper buys a big old house, maybe two or three. Pricey vehicles are purchased, and money is given to family and friends. But as time rolls on, and new stars get introduced to the public, performance opportunities might slow down, which means the money does, too.

Obviously, creditors don't care why a person is having financial difficulties; they just want their dough. So, the entertainer finds themself in deep trouble, which sometimes takes years to be remedied.

Or, in another scenario, a celeb lives lavishly and doesn't owe creditors, but they failed to give the IRS its cut. That's equivalent to owing the mafia money, in terms of how seriously the feds take an outstanding debt. Here's a list of country stars who fall into these categories, with some of them perhaps spending too much too soon and others acting as if paying the IRS is an option. Some made bad business decisions, as well.

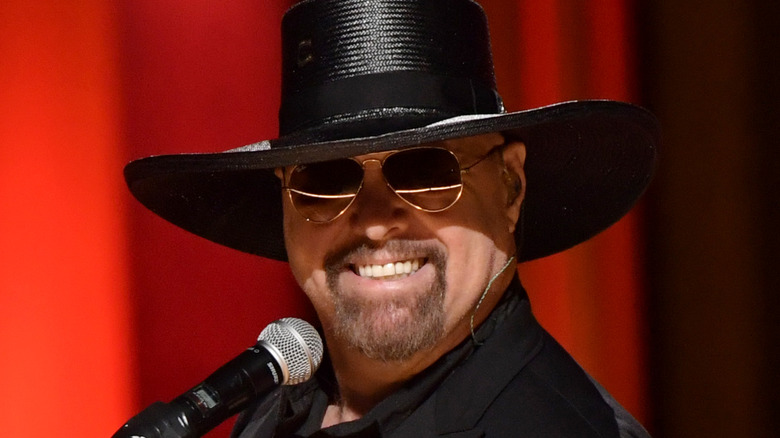

Eddie Montgomery's business hurt his pockets

Kenny Rogers, Alan Jackson, and Florida Georgia Line. Those are just a few of the country artists who've opened restaurants. As of 2023, all of their places are still open. But the same can't be said for Eddie Montgomery's restaurant, of the country duo Montgomery Gentry. He launched Eddie Montgomery's Steakhouse in Harrodsburg, Kentucky, in 2009 with his wife Tracy Nunan.

By 2010, however, the couple was no longer married, and three years after that, the steakhouse was closed. The failed business had much to do with Montgomery being in debt for almost $12.7 million after taking out some hefty business loans. He filed for bankruptcy in 2013, per CMT.

Of course, whether Montgomery couldn't afford his lifestyle is a matter of opinion for those outside of his financial situation. But he and his ex-wife lived in a home in Perryville, Kentucky that sat on 273 acres of land. So, it's possible it was costly to maintain. However, that's not the reason the bankruptcy was filed, according to Montgomery's lawyer. "It is very common with individuals dealing with divorce and business closure to have to seek out bankruptcy trying to maintain a restaurant," said attorney Jamie Harris, according to 97.3 The Dawg.

Merle Haggard had to sell his songs

Here's a scenario that could be called unfair: You're a singer-songwriter who's crafted hundreds of songs, some more popular than others. Maybe at one point, you planned to leave the rights to those songs to your children. But sadly, that never happens because you have to sell them to pull yourself out of a deep financial hole. That's what happened to the late, beloved country singer Merle Haggard, who filed for Chapter 11 in 1992 after being a reported $5 million in debt.

"I think this is all for my benefit, to stand back and appraise things where nobody can touch me for a little bit," Haggard told the Nashville Banner about filing for bankruptcy (via the Orlando Sentinel). "Hopefully, I won't be in there long."

The Los Angeles Times reported that some of Haggard's money problems stemmed from tax issues. Rolling Stone said bad business moves and a string of divorces contributed, as well, since he was married five times. Plus, Haggard had a contentious relationship with his label, Curb Records, and accused them of stalling his career. So, to help pull himself out of debt, the Oildale, California native sold 600 of his songs to Sony-Tree Publishing for over $3 million, per Deseret News. He had to sell hundreds of acres of personal property on top of that.

The Clark Family Experience moved back home

Like Merle Haggard, The Clark Family Experience, a country band that consisted of six brothers, was also on Curb Records and they, too, filed for bankruptcy. It happened in the early aughts when the siblings moved from Virginia to Nashville, Tennessee to live out their music dreams. But it appears the city wasn't kind to them financially, as they were pretty much living hand to mouth. Billboard reported they were $800,000 or more in debt. "They were forced to move from Nashville back to the family farm in Rocky Mount, Virginia," said the band's lawyer J.D. Larson. "They had no money to pay for things such as rent, bus maintenance bills, or even a nutritious meal. They were eating ramen noodles."

Larson also said the brothers, who ranged between 18 to 27 at the time, made some poor financial decisions, but he didn't elaborate. Lead singer Alan Clark spoke about the band's financial challenges with the Herald Journal. "Finally, it was like, we can't do this anymore," he explained. "Our finances were hurting, so we filed Chapter 7 bankruptcy, and now all heck is breaking loose. It's been a lot of drama."

So did Alan, Andrew, Austin, Adam, Ashley, and Aaron Clark live too lavishly in Nashville? Only they and those close to them can say. But maybe they should've lived with their folks a while longer. At least until their success steadied some.

Lorrie Morgan regrets not saving more

In 2003, country music singer Lorrie Morgan bought a home in Gallatin, Tennessee. By 2008, the Nashville Post reported that her assets were between $500,000 and $1 million. Her property purchase came at a time when she was well into her music career and had established herself as a star. Her first album was 1989's "Leave the Light On."

But unfortunately for Morgan, she got into some serious money problems and found herself millions of dollars in debt, so she filed for Chapter 7 bankruptcy. She made the decision on the heels of filing for divorce from Sammy Kershaw, another famous country singer, so she was clearly dealing with plenty. To boot, SunTrust Bank came for her home, said to be a colossal 4,700 square feet, after it was said she owed over $17,000 in mortgage payments.

"It was the biggest mistake of my life that I didn't watch my own money," Morgan told The Boot in 2016. "And I would say to anybody: You have an accountant that does your money? You audit them. You be the co-signer of those checks. You know where every check goes and keep track of your money because one day you're going to wake up and go, 'What do you mean I don't have any money?' ... Make it, put it away, and save it because just as quick as you go up, you come back down."

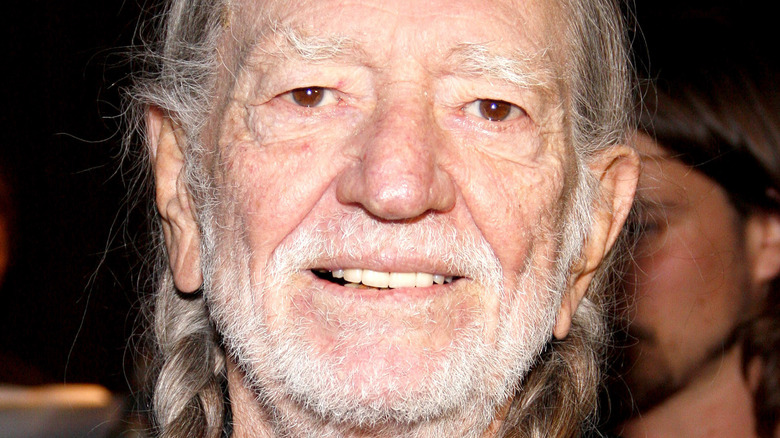

Willie Nelson's home was raided

There have been times throughout music history when singers have used their art to settle a legal matter. In 1978, for example, Marvin Gaye released "Here, My Dear" and used the royalties to pay alimony to his ex-wife, Anna Gordy Gaye. And in 1991, Willie Nelson released his LP "The IRS Tapes: Who'll Buy My Memories?" to pay off a massive tax debt, said to be $16.7 million.

Per Forbes, the amount was whittled down to $6 million, thanks to Nelson's lawyer. But after the star failed to pay that amount, the feds raided his home in 1990 and seized his assets, including his recording studio, instruments, and other properties.

Later, the IRS allowed the country legend to pay off the debt with his "Who'll Buy My Memories?" album, but he needed to sell four million copies. Based on the financial split that was agreed upon with those involved in the album, the IRS received just $3.6 million. But thankfully for Nelson, he was able to pay off the remaining debt in the following years. "I thought they'd be crazy not to take it," he told The New York Times in 1991. "The very fact they see a way to make a lot of money real quick made them go for it. They're not interested in sitting around waiting 10 or 20 years for the money to trickle in."

Johnny Paycheck had multiple problems

Late country singer Johnny Paycheck, of "Take This Job and Shove It" fame, may have lived too lavishly, seeing that he owed the IRS a reported $103,000 and the state of Tennessee over $1,600. It could be said that anyone who has a huge tax debt is living beyond their means (maybe they are spending as if 100% of their earnings are theirs and nothing goes to the IRS). So, in 1982 Paycheck filed for bankruptcy, per UPI, and he did it about half an hour before the feds were going to auction off his personal belongings.

Paycheck was also in trouble with the police because he was arrested in 1981 for sexually assaulting a minor (per The New York Times). Her guardians eventually sued him for $3 million but under the Bankruptcy Act, the suit had to be postponed after Paycheck filed. He only received one year of probation and a $1,000 fine.

The self-proclaimed outlaw was arrested in 1985 after shooting a man at a Hillsboro, Ohio bar. He was sentenced to nine years in prison but was released in 1991 after then-Ohio governor Richard Celeste granted him a pardon (per Rolling Stone). But while he was behind bars, the U.S. attorney's office tried to collect over $1.6 million in back taxes from Paycheck, saying that he didn't pay his taxes between 1980 and 1982.

If you or someone you know may be the victim of child abuse, please contact the Childhelp National Child Abuse Hotline at 1-800-4-A-Child (1-800-422-4453) or contact their live chat services.

If you or anyone you know has been a victim of sexual assault, help is available. Visit the Rape, Abuse & Incest National Network website or contact RAINN's National Helpline at 1-800-656-HOPE (4673).

Sammy Kershaw's restaurant put him in the hole

Similar to Eddie Montgomery, Sammy Kershaw had a business that went belly up, and it got him into all kinds of debt. He started Hotchickens.com in Whites Creek, Tennessee, with Lorrie Morgan before they split in 2007. Then, after the restaurant closed, creditors came knocking. The Nashville Post reported that Kershaw was in debt for an amount that ranged between $100,001 to $1 million, which he indicated in his Chapter 13 filing.

On top of that, Kershaw — who was dropped by his label Mercury Records in 2000 — was in the hole for $89,676 in alimony payments to his ex-wife Kim Kershaw, per the Nashville Post. His debt was also related to credit card purchases, leasing buses, self-storage costs, and back taxes. Plus, a bunch of vendors sued him for non-payment. Kershaw spoke about his money problems with The Boot in 2010, and it seemed like he regretted filing for bankruptcy.

"I don't recommend bankruptcy to anybody if you can work it out. And a lot of people are willing to help and work with you, but sometimes there's a point where even the little bit of help don't help anymore," he said. "My advice is to do everything you can to avoid bankruptcy because it is a tough thing to get over. It's a tough thing to start over ... Your credit is shot for a long time. ... It can almost be like a divorce."