Celebs Who Went Broke This Past Decade

The Great Recession even hit Hollywood hard. From 2010 through 2019, stars who were at one point the most bankable in Hollywood had a tough time balancing their checkbooks. Some stars, insulated in a bubble of wealth and lifestyle creep, believed their management teams would handle their money— and then accused said management teams of squandering their fortunes. Others were casualties of poor real estate deals and the markets crashing. Some made foolish investments, while others were sidelined by health problems that made it hard to pay their bills — and were then slapped with medical bills on top of the debts they'd already incurred. Others simply had beer budgets and champagne tastes.

Whether through avarice of their own or of alleged vultures surrounding them — or just from pure stupidity in overspending or downright terrible luck — these stars all went broke this past decade. Here's hoping their hindsight and foresight helps improve their bank accounts in 2020.

Lisa Marie Presley blew the King's fortune

Lisa Marie Presley sued her former business manager, Barry Siegel, in 2018 for allegedly squandering the more than $100 million fortune she inherited from her father, Elvis Presley's estate. The Blast reported that Presley accused Siegel of poorly investing money from her trust and of selling her assets when the investments tanked, leaving her with just $14,000 — and $500,000 in debt. She also claimed that Siegel purchased a $9 million home in England using the trust, and risked her entire fortune when he couldn't afford the $6.7 million balloon payment.

In more documents later obtained by the Daily Mail, Presley claimed Siegel charged her $700,000 annually to manage the trust. The documents noted, "Had Siegel disclosed the trust's true financial condition to Presley and restricted spending to the trust's 'income' rather than its principal assets, Presley would have lived comfortably on an annual budget of between $1.5 and $2 million per year, after taxes. On this budget, Siegel's lucrative compensation package would have amounted to between 40 to 50 percent of Presley's post-tax annual budget — an amount she undoubtedly would not have agreed to had she been aware of her true financial condition."

Siegel denied the claims and said Presley being "financially devastated" was her fault, adding that one of Siegel's investments paid $20 million of her previous debts and netted $40 million, "most of which she managed to squander in the ensuing years."

Johnny Depp blamed everyone else for his busted bank account

In January 2017, Johnny Depp sued The Management Group (TMG) — along with 14 other entities — for $25 million, alleging "gross misconduct" that cost him "tens of millions of his dollars," Variety reported. (According to The Hollywood Reporter, Depp made $650 million while working with TMG.) TMG denied the allegations, saying that for 17 years "They did everything possible to protect Depp from his irresponsible and profligate spending." TMG also alleged that Depp only repaid $800,000 of a $5 million loan from the company.

Regardless of their management of his funds, Depp certainly didn't live frugally: In court documents obtained by the New York Post, TMG alleged that Depp spent $2 million per month (including $30,000 on wine alone) in addition to blowing $18 million on a yacht, $75 million in real estate, and hundreds of thousands of dollars on full time staff. Page Six reported that Depp refused to sell his private jet to recoup some cash. TMG also alleged that they "[bailed] him out of numerous legal crises, including making a series of hush money settlements." The lawsuit between Depp and TMG was reportedly settled in July 2018 to undisclosed terms, but Deadline pointed out that Depp still faced other numerous, potentially costly lawsuits that were both civil and criminal in nature. It looks like retirement may not be in the cards for Captain Jack Sparrow in the 2020s.

Dionne Warwick could have used what rich friends are for

You'd think the artist behind a timeless schmaltzy tune would be set for life, but that wasn't the case for "That's What Friends Are For" singer Dionne Warwick, who filed for bankruptcy in March 2013. TMZ reported that Warwick claimed just $25,000 in assets and $10.2 million in back taxes and IRS penalties and interest alone. Warwick listed her income as $20,950 a month, but her expenses as $20,940 a month (including $5,000 on housekeeping and $4,000 on her personal assistant), leaving her with net gains of just $10 each month.

Her rep said in a statement at the time, "In light of the magnitude of her tax liabilities, Warwick has repeatedly attempted to offer repayment plans and proposals to the IRS and the California Franchise Tax Board for taxes owed. These plans were not accepted, resulting in escalating interest and penalties." In 2015, The National Enquirer reported that Warwick's debts were all forgiven except her back taxes, for which she was ordered to pay $3.6 million.

Alyssa Milano sued her manager for millions

In June 2017, actress-turned-activist Alyssa Milano sued her former business manager, Kenneth Hellie, for $10 million. She accused Hellie of "severe misconduct," including "failing to pay overdue bills and taxes" and making poor "investments in businesses in which he also was an investor." The latter was a potential conflict of interest, of which Milano claimed she was not informed.

Variety reported that Milano's financial troubles started with a $5 million renovation on her home — which was "worth no more than $3 million" at the time. Additionally, she incurred $376,950 in code violation fines and a lien. She also allegedly had eight late mortgage payments within 13 months; her credit was so poor that she reportedly was "unable to refinance her home" to get out of the red.

Milano also claimed that because Hellie never alerted her to her financial foibles, she walked away from a $1.3 million salary for a third season of the show Mistresses. Milano fired Hellie in June 2016, then accused him of forging a $26,000 check ... which she only found out about when her account overdrafted. Hellie alleged that Milano and husband David Bugliari lived beyond their means and denied any wrongdoing. The suit was settled in June 2019.

Tori Spelling and Dean McDermott can't hide from their creditors

Tori Spelling and Dean McDermott don't get a ton of TV work anymore, but they seem to spend like they're making Friends money. Per E! News, in May 2017, the couple lost a default judgment in a lawsuit from City National Bank and were ordered to pay $220,000 after they failed to pay off a 2010 loan for $400,000. A month earlier, Page Six reported that the IRS "emptied [the couple's] bank accounts" to recoup $704,000 in back taxes just from 2014. In January 2019, American Express sued Spelling for the second time (the first was in October 2016) for unpaid bills totaling more than $88,000.

Spelling and McDermott's debts weren't limited to Uncle Sam and plastic. In March 2017, McDermott narrowly avoided jail time for not paying an alleged $100,000 in back child support to his ex-wife Mary Jo Eustace. Spelling said in her 2013 memoir Spelling It Like It Is that her and McDermott's financial troubles were the result several factors: Her "expensive tastes," a real estate deal gone wrong that "lost almost a million dollars," and some unsuccessful business ventures.

A lesser Baldwin has a lesser bank account

Page Six reported that Stephen Baldwin, best known for Biodome and spawning Justin Bieber's wife, had his Rockland County, N.Y., home foreclosed in February 2017 and auctioned to cover his massive debt on the property: In 2013, Baldwin's bank sued him, claiming the actor defaulted on his $7,000 mortgage and owed over $1 million on the property at the time of the foreclosure. By 2016, Baldwin's mortgage debt plus interest and fees ballooned to nearly $1.1 million, according to the Daily Mail. On top of those issues, Baldwin was also hit with $1 million lien for unpaid taxes and fees on the property. The Blast reports he's since moved into an apartment in Queens, N.Y.

This all went down after Baldwin previously filed for bankruptcy in 2009, claiming that he owed over $2.3 million in mortgage payments and taxes (per The Hollywood Reporter), and $70,000 in credit card debt.

It seems that tax bill wasn't just related to Baldwin's foreclosed home, either. In March 2013, Baldwin pleaded guilty to not filing personal income taxes for three years, owing more than $300,000 to the IRS, according to CNN. He reportedly owed $400,000 with interest included, but a judge deducted the added fee for a total of $350,000, which his legal team then negotiated down to $300,000. The Associated Press reported that Baldwin paid off his back income taxes in 2014 with help from a loan from an unidentified pal.

T-Boz's bank accounts can use a little TLC

Tionne "T-Boz" Watkins first declared bankruptcy with the rest of TLC back in 1995 and nearly lost her Georgia property to foreclosure in 2009. Unfortunately, her money troubles followed her into the 2010s: Billboard reported that the singer filed for Chapter 13 bankruptcy protection in October 2011 after failing to pay nearly $769,000 on her $1.2 million Duluth, Ga. property. In the filing, she listed her assets at over $1.7 million. At the time, her monthly income of $11,700 was enough to cover the $8,000 in reported monthly expenses, which went towards her two mortgages, two vehicles, and medical bills for her sickle-cell anemia and a brain tumor that she suffered in 2009. Still, not all of her financial issues were her own fault, because she also had an ex who owed her $250,000 in back child support at the time of her bankruptcy filing.

However, in February 2012, TMZ reported that her bankruptcy protection was dismissed after she allegedly failed to complete the proper paperwork, allowing creditors and bill collectors to go after her assets, like her Odyssey minivan that Honda tried to repossess. She sold her Duluth mansion in August 2012 for just $680,000 (a loss from the $1,122,700 for which she purchased it back in 2001).

Gary Busey went bankrupt

In February 2012, TMZ reported that Gary Busey filed for bankruptcy. In the filing, the once-prolific film actor-turned-reality-TV-star claimed be had roughly $50,000 in assets and between $500,000 and $1 million in debt. Busey owed money to the IRS, UCLA Medical Center, a storage company, L.A. County Waterworks, and Wells Fargo, as well as to a woman who sued him for allegedly attacking her at a Tulsa, Okla., airport nine months earlier. Busey's rep told the site, "Gary's filing is the final chapter in a process that began a few years ago of jettisoning the litter of past unfortunate choices, associations, circumstances and events."

Fortunately for the Gingerdead Man star, he settled most of his debts by December 2012, according to the Daily Mail. Busey was let off the hook for about $57,000 in unpaid bills to some creditors, and allowed to keep $26,000 worth of his assets. However, he still had to pay $450,000 in back taxes.

Lil' Kim became all about the George Washingtons

Lil' Kim hasn't had a hit since 2005's "Lighters Up" from her album The Naked Truth peaked at #31 on Billboard's Hot 100 chart, but that hasn't curbed her spending. In June 2018, The Blast reported that Lil' Kim filed for Chapter 13 bankruptcy protection, listing nearly $2.6 million in assets (including her $2.3 million New Jersey home and $25,000 worth of jewelry) and just under $4.1 million in debt.

The Queen Bee of the Big Apple owed nearly $2 million to Uncle Sam in back taxes alone, plus $186,000 in legal fees and another $2 million to a loan company for her New Jersey property. The "Jump Off" rapper also alleged in her bankruptcy filing that she receives no child support from Jeremy Neil, the rapper known as Mr. Papers, the father of her daughter, who she says she's raising alone.

And while that all sounds pretty dire, she also claimed a very healthy monthly income of $43,000 for her business Queen Bee Entertainment. From that gross, she claims to have approximately $25,000 in overhead, leaving around $18,000 left in profit. Does that still qualify her as being "All About the Benjamins?"

Sinbad's debt was no laughing matter

The fleeting nature of fame hit Sinbad hard. The actor and comedian filed for bankruptcy in 2013, with TMZ reporting that he was almost $11 million in the red compared to his $131,000 in assets. This was his second bankruptcy filing — the first time was in 2009, but "the case was dismissed because he didn't file the right documents." For the 2013 filing, his debts were largely due to back taxes — $8.3 million in state and federal arrears. On top of that, the Houseguest star owed $374,979 to American Express and another $32,199 to Bank Of America in outstanding credit card debt.

Sinbad told Huffington Post that his financial issues weren't due to a lavish lifestyle, but to poor business management, explaining that he spent a lot of cash on salaries for employees and equipment for his company. Add on taxes, interest and fees, he said, and times got even tougher — and didn't turn around in time. "I spent money, and I kept thinking, 'I get one more movie and I'll wipe these bills out,' but that movie never came," he admitted.

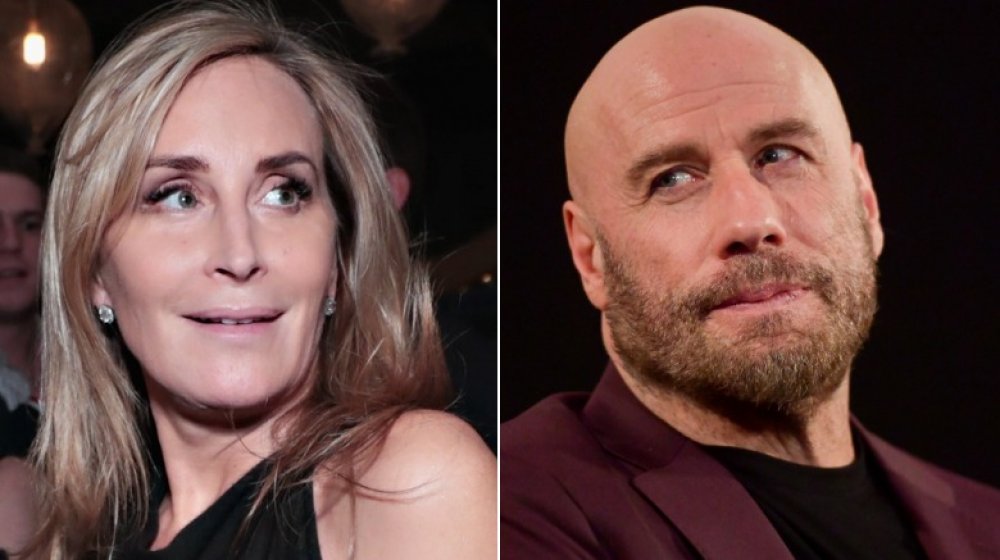

How was John Travolta involved in Sonja Morgan's bankruptcy?

Real Housewives Of New York star Sonja Morgan filed for Chapter 11 bankruptcy protection in 2010, claiming she lost $7 million in a bad deal for a film called Fast Flash To Bang Time. John Travolta had been in talks to star in the movie but never signed on because Morgan couldn't meet his demands, according to E! News. Hannibal Pictures, which was slated to partner with Morgan's production company on the film, won a $7 million judgment against her, but Morgan told the outlet that "with the administration fees," she ended up on the hook for "$9 million-plus."

Still, Radar Online reported that the trustee tasked with evaluating Morgan's assets and liabilities throughout the bankruptcy process allegedly uncovered her own extravagant lifestyle, including expenditures averaging $34,000 every month. What was she spending on? The tab claimed it broke down, in part, as: "$1,804 for travel and entertainment, $4,385.89 in food, clothing and hygiene, $1,573 in medical costs and other expenses."

In 2015, Morgan sold her homes in France and Colorado to finally pay off her debts. She kept her New York City townhouse, however, which she later rented out for $32,000 a month after she got a new, smaller pad. She told E! News, "I paid what I had to pay and it wasn't easy, but at the same time it was an experience. It's nice to be free of everyone looking at my money. I finally have my financial privacy back."

Toni Braxton un-broke her financial problems

Toni Braxton filed for bankruptcy twice — first in 1998, then again in 2010. She said that her 1998 bankruptcy filing was due to a combination of expensive taste (especially in luxury housewares) and a less-than-stellar recording contract. The "Un-Break My Heart" singer told ABC News that despite selling $170 million worth of her music around the world, she only pocketed $1,792 from royalties after having to pay back her record company's advancements after music videos and touring costs. In her memoir, Unbreak My Heart (via Radar Online), she admitted to a penchant for Gucci flatware, grand pianos, and designer gowns. She also suffered health problems, including the autoimmune disease lupus, but didn't reveal it to her record label because she was scared they'd think she couldn't perform.

She rebounded with a new deal in 2000 and settled her debts, but unfortunately, Braxton never appeared to have learned how to balance her checkbook. She filed for bankruptcy again in 2010, citing between $10 million to $50 million in debt and only $1 million to $10 million in assets. She told ABC News it was due to poor record sales, as well as canceled performances due to illness. TMZ reported that Braxton settled her second bankruptcy case in 2013 for just $150,000. She reportedly purchased a $3 million home just months later.

Mekhi Phifer's back taxes bankrupted him

In 2014, actor Mekhi Phifer filed for bankruptcy, claiming $67,000 in assets, including a leather bed, a Segway and three firearms, and debts totaling about $1.3 million. Most of his debt was in the form of back taxes ($1.2 million), plus $4,500 in back child support and an additional $50,000 in attorney's fees. In legal documents obtained by TMZ, the erstwhile ER star claimed income of $7,500 a month, but that more than $11,000 in average monthly expenses.

Thankfully, the 8 Mile actor has worked relatively steadily the last several years: Per IMDb, since 2014, Phifer has appeared in Divergent, A Day Late And A Dollar Short (art imitating life?), Insurgent, Pandemic, Allegiant, The Bobby Brown Story, and Canal Street, as well as several TV series, including Truth Be Told, House Of Lies, Secret City, Frequency, Roots and Chicago P.D. The Lie To Me alum also has several upcoming projects in pre-production.

Janice Dickinson went from supermodel to super broke

The self-proclaimed world's first supermodel, Janice Dickinson, filed for bankruptcy in 2013. She admitted to Radar Online, "I had some trouble, so yes, it is true. I am upset and taking every step to pay everyone back and I feel terrible about it." According to the New York Post, Dickinson owed more than 10 years of back taxes totaling about $500,000. She also reportedly owed money to a dermatologist and a plastic surgeon. In 2014, TMZ reported that Dickinson also owed nearly $300,000 in bank overdraft fees, but settled the debt for $100,000. Her husband, psychiatrist Robert Gerner, reportedly paid the debt off for her.

Dickinson wasn't completely out of the red yet, however. In 2016, the Daily Mail reported that after Dickinson accused disgraced comedian Bill Cosby of sexual assault, one of Dickinson's bankruptcy trustees accused the former America's Next Top Model judge of lying about potential legal claims in her 2013 bankruptcy filing. The trustee quickly withdrew their claim.